va-Q-tec: Global specialist for TempChain transport solutions and energy efficiency continues on successful track in the first half of 2022

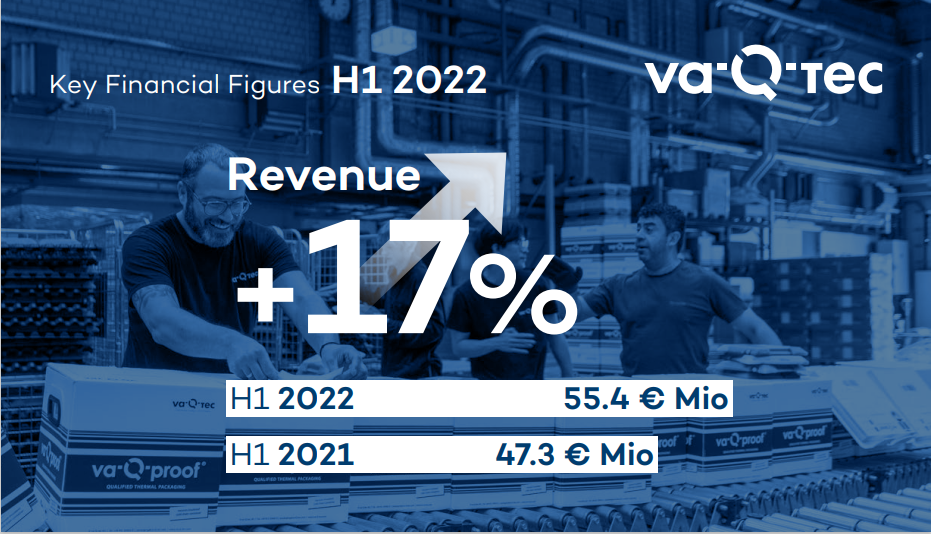

- Revenue growth of 17% in the first half of 2022 to EUR 55.4 million after EUR 47.3 million in H1 2021

- Particularly significant growth in the Services (+30%) and Systems (+21%) divisions, including strong growth in the non-Covid-related TempChain business of +28% y-o-y in the first half of 2022, above growth of overall TempChain business at +25%

- Continued high profitability with stable earnings trend despite general rise in logistics and energy costs, reflecting a considerable EBITDA increase since Q1

- EBITDA in the first half of 2022 at EUR 9.1 million after also EUR 9.1 million in H1 2021; EBITDA margin at 17% in the first half of 2022 after 19% in H1 2021

- Significantly improved operating cash flow and normalized investing cash flow; free cash flow improves by around EUR 7.5 million in the first half of 2022; positive free cash flow expected to continue for the full year

- Further international expansion through the establishment of three subsidiaries in China, India and Brazil

- FY 2022 guidance confirmed

Würzburg, 11 August, 2022: va-Q-tec AG (ISIN DE0006636681 / WKN 663668), a pioneer in highly efficient products and solutions in the thermal insulation (so-called super insulation) and temperature-managed supply chains (so-called TempChain logistics) area, continued on its past quarters’ profitable growth path in the first half of 2022. Revenue growth in the first half of 2022 was very gratifying overall despite the challenging macroeconomic environment, thanks to the highly sought-after product and service portfolio. Revenues increased strongly by 17% year-on-year to EUR 55.4 million in the first half of 2022 (H1 2021: EUR 47.3 million). The coronavirus business accounted for 13% of revenues in the first half of 2022, compared with also 13% in H1 2021. Despite generally higher expenses for energy, logistics and personnel as well as travel and trade fair activities that have increased to normal levels, earnings before interest, tax, depreciation and amortization (EBITDA) remained constant year-on-year at EUR 9.1 million in the first half of 2022 (H1 2021: EUR 9.1 million), resulting in an EBITDA margin of 17% in relation to revenue (H1 2021: 19%). As Q2 2022 already showed a marked uptrend in profitability compared to Q1 2022 despite the aforementioned cost factors, the Management Board expects this positive trend to continue over the course of the year in line with the expected expansion of business activities.

Dr. Joachim Kuhn, CEO of va-Q-tec AG, comments: “With our products and solutions, we address challenges of global megatrends such as energy efficiency, security in temperature-sensitive supply chains and the globalization of value chains. The good performance in the first half of 2022 underlines our strong market position, the resilience of our business model and our attractive development and growth prospects. We are convinced that we are only at the beginning of our growth story because va-Q-tec is not only valued as a reliable partner in the healthcare & logistics sector, but also in numerous other areas such as technology and industry, the construction industry and the mobility sector. For example, our products can be deployed in pipeline insulation, building insulation and high-tech insulation for electric vehicles, significantly enhancing energy efficiency in these areas.”

For the individual divisions of va-Q-tec AG, the overall trend was as follows: The Services division, which comprises the container and box rental business for the transport of temperature-sensitive goods mainly from the pharmaceutical and biotech sector, recorded strong year-on-year revenue growth of 30% to EUR 25.9 million in the first half of 2022 (H1 2021: EUR 19.9 million). Overall, va-Q-tec benefited from a broadening of its customer base, particularly in the area of airfreight thermal containers, as well as a strong increase in the number of small thermal box rentals for “last mile” shipments. In the Systems division (sale of thermal packaging), revenues grew by 21% from EUR 14.4 million in the previous year to EUR 17.4 million. Overall, the non-Covid-related TempChain business thereby grew by +28% in the first half of 2022 and the TempChain business as a whole grew by +25%. In the Products division (sale of vacuum insulation panels and phase change materials), revenues of EUR 10.6 million were down compared with the previous year’s very strong basis (H1 2021: EUR 12.5 million). In the prior-year period, this division had still benefited strongly from the significant increase in demand for energy-efficient refrigerators and freezers in consumer markets. By contrast, business performed very well in other end markets in the reporting period, especially in the technology and industrial sectors. Business with the innovative insulation solution “va-Q-shell pipe”, which was developed together with Finnish partner Uponor, is a prime example.

In order to be able to leverage potentials worldwide, va-Q-tec continued its international expansion in the first half of 2022, and founded three new subsidiaries in India, China and Brazil. The founding of the new subsidiary in India is the logical response to the strong growth in India’s pharmaceutical sector. Through the new subsidiary in China, the new opening in Shanghai will address one of the most important transshipment hubs of the Chinese pharmaceutical industry. The new site in São Paulo, Brazil, enables va-Q-tec to optimize the availability of TempChain solutions, with the company now operating a network of nine subsidiaries worldwide. Despite the expansion of business activities and the further internationalization of the Group, va-Q-tec’s liquidity recorded a positive trend. With operating cash flow of EUR 1.7 million (H1 2021: EUR 0.4 million), free cash flow was still negative overall but improved significantly, by approximately EUR 7.5 million year-on-year, by approximately EUR 7.5 million year-on-year, particularly because of a normalized level of investments.